Trend Following vs Trend Chasing

My previous post returned to a discussion of trend following. This is one of my favorite investing topics, and as a result, ideas related to trend following are often in my thoughts. In this post, I wanted to take the opportunity to mention a few ideas related to trend following that I’ve been thinking about recently.

Who Counts as a Trend Follower?

In his most recent memo, Howard Marks described the behavior of retail investors, who tend to buy stocks after large gains and sell them after large losses. He then wrote:

We know that “retail investors” tend to be trend-followers, as defined above.

While I do not dispute that the behavior he described is an accurate description of retail investors, I bristled at the description of this as “trend following”, which is a strategy with a multi-century track record of limiting drawdowns and certainly does not entail selling after large losses. My previous post includes a discussion of how well one trend following strategy that I use is navigating the current markets. (Most trend followers have had great performance the last two years.)

Systematic trend followers reacted to these comments in the way that, I imagine, value investors would respond to Cathy Wood’s investment style being described as “value investing”. (See, e.g., this episode of Top Traders Unplugged, starting at 13 minutes.) Not every strategy that buys stocks that are going up is trend following, just as not every strategy that buys stocks based on some claim of cheapness is value investing.

As with most topics in investing, Warren Buffet got to the essence of the matter when he said:

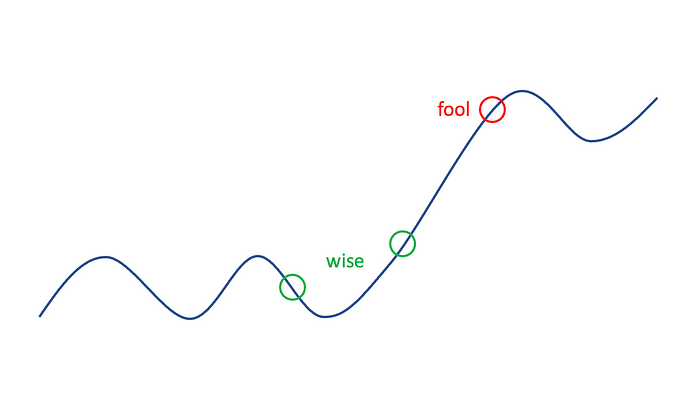

What the wise man does in the beginning, the fool does in the end.

The unwise investor buys after large profits have been made (e.g., at the red circle above). When they see that others are booking large gains, they rush in. Nature abhors a “get rich quick” scheme.

In contrast, trend followers buys near the beginning of a trend, often at the point where the price is “breaking out” from a previous range. This is the second green circle in the figure above above.

To avoid confusion with trend following, I would refer to the retail strategy as “trend chasing”. This matches the terminology we use for buying into strategies after strong outperformance, which we call “performance chasing”. In technical analysis, they refer to buying stocks long after an uptrend has commenced as “chasing extended stocks”. In short, trend followers join the trend near the beginning, while trend chasers join near the end.

Trends from a Fundamental vs Technical Perspective

The Buffett quote above comes is part of a longer discussion on the topic of trends. (The video is available here.) In it, he says:

It’s like most “trends”. At the beginning, it is driven by fundamentals, and at some point, speculation takes over.

The view that most trends have explanations in fundamentals is shared by many trend followers / technical analysts. JC Parets likes to say that “technical analysis is short-cut fundamental analysis”. Academic studies have also found that the vast majority of price momentum is due to momentum in the underlying fundamentals.

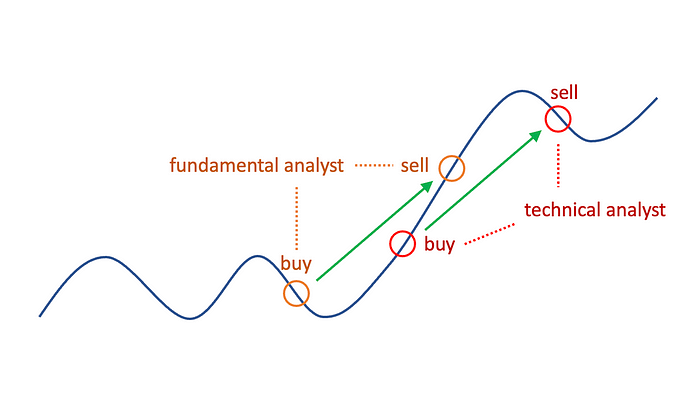

Both fundamental and technical approaches can be used to profit from trends, albeit by buying and selling at different times. I’ve tried to depict that here:

While the fundamental analyst hopes to identify a change in fundamentals before it is reflected in price, the technical analyst waits to buy until the change is starting to be reflected in price. While the technical analyst will wait until the price trend comes to an end before selling, the fundamental analyst will usually sell once the changed fundamentals are fully reflected (or more) in the price. As Buffett notes above, that point may come well before the uptrend in price has ceased.

As I’ve tried to illustrate in the picture, the two strategies can have equal profit potential. The advantages of the technical approach (trend following) that are not well-known to fundamentals-oriented investors are (1) its down-side protection (limiting losses is the primary goal of trend following) and (2) its potential to profit without knowing the reasons for the trend. Many trend followers have found that the most profitable trends are actually the ones where no one seems to understand the reasons until it is nearly over.

Combining Fundamental and Technical

Although it seems to be rare amongst individual investors, the fundamental and technical approaches can certainly be combined. Bill O’Neil’s career is a prominent demonstration of that fact.

Surprisingly, however, the two approaches seem to be combined frequently by “macro” strategies. Niels Kaastrup-Larsen once said that, when George Soros was famously breaking the British pound, all the systematic trend followers at that time were in the trade as well. Others have stated that this was true in general for Soros’s trades. More recently, Rob Koyfman said that most macro funds nowadays explicitly use trend following strategies. Yannick Kälber put it most succinctly:

Carry is certainly fundamental, while trend is technical. In macro, it appears that practitioners are able to utilize the advantages of both toolkits, rather than focusing their efforts on defending one and disparaging the other. That is something to which the rest of us can aspire.

Conclusions

While information that confirms prior beliefs always seems to be in high demand, I find myself most interested in information and perspectives that differ from what I have learned thus far. As a value investor by training, learning about trend following has been a great example of the benefits of that approach. Trend following is a strategy with a great track record that solves an important problem — limiting drawdowns. As such, it deserves to be in every value investors thoughts as they look for strategies to achieve their investing goals.